In the realm of personal finance, the journey to financial freedom often involves navigating a landscape of debts, big and small. For many, the path to prosperity can be obscured by the weight of loans and credit card balances. This is where the Debt Avalanche Spreadsheet strategy emerges as a beacon of hope, guiding individuals toward a debt-free future and financial independence.

Understanding the Debt Avalanche Approach

The Debt Avalanche method is a debt reduction strategy designed to minimize the overall interest paid while accelerating the debt repayment process. Unlike its counterpart, the Debt Snowball method, which prioritizes paying off the smallest debts first, the Debt Avalanche approach takes a more financially strategic route.

How It Works

The core principle of the Debt Avalanche strategy is to prioritize debts based on their interest rates, tackling the highest interest rate debts first. Here’s how it works:

- List Your Debts: Begin by cataloging all your debts, whether they’re credit card balances, personal loans, student loans, or any other outstanding obligations.

- Interest Rate Ranking: Order your debts from highest to lowest interest rate. The debt with the highest interest rate takes the top spot on your list.

- Minimum Payments: Continue making the minimum monthly payments on all your debts. This ensures that you don’t fall behind on any obligations.

- Extra Payments: Allocate any extra funds you can muster toward the debt with the highest interest rate. This is where the Debt Avalanche gains its momentum.

- Snowball Effect: As you successfully eliminate the debt with the highest interest rate, roll over the amount you were paying on it (minimum payment + extra) to the next debt on the list. This creates a snowball effect, where your debt repayment power grows with each conquest.

- Repeat and Conquer: Continue this process until you’ve paid off all your debts, systematically moving down the list from the highest interest rate to the lowest.

By adhering to the Debt Avalanche strategy, you’re effectively chipping away at the costliest debts first, saving you money on interest payments in the long run. This method harnesses the financial principle that reducing high-interest debt is often more beneficial than eliminating smaller debts.

Benefits of the Debt Avalanche Spreadsheet

1. Financial Efficiency: The Debt Avalanche approach is financially efficient, as it targets high-interest debts that can accrue substantial interest costs over time.

2. Interest Savings: By prioritizing the highest interest rate debts, you ultimately reduce the total amount of interest paid throughout your debt repayment journey.

3. Faster Debt Elimination: The Debt Avalanche strategy allows you to eliminate debts faster than traditional methods, providing a sense of accomplishment and motivation.

4. Enhanced Credit Score: As you pay off debts, your credit score can improve, opening doors to better financial opportunities.

5. Long-Term Financial Freedom: The ultimate goal of the Debt Avalanche method is to free you from the burden of debt, providing the financial freedom to pursue your life goals and aspirations.

Implementing the Debt Avalanche Spreadsheet

To implement the Debt Avalanche Spreadsheet method effectively, it’s beneficial to use a Debt Avalanche Spreadsheet. This spreadsheet allows you to:

- Input your debt details

- Automatically calculate the interest savings

- Track your progress

- Visualize your debt repayment journey

Creating a Debt Avalanche Spreadsheet is relatively simple. Here’s how to do it:

Step 1: Open a Spreadsheet

You can use software like Microsoft Excel, Google Sheets, or even a pen and paper if you prefer a manual approach.

Step 2: List Your Debts

Create columns for the following:

- Debt Name

- Outstanding Balance

- Interest Rate

- Minimum Payment

- Total Payment (minimum + extra)

Step 3: Input Your Debt Details

Enter the details of your debts in the respective columns.

Step 4: Calculate Extra Payment

In a separate column, calculate the extra payment you can afford to make each month. This will be the difference between your total available funds and the sum of minimum payments.

Step 5: Sort by Interest Rate

Sort your debts by interest rate in descending order, with the highest interest rate debt at the top.

Step 6: Track Your Progress

Regularly update your Debt Avalanche Spreadsheet to track your progress. As you pay off a debt, remove it from the list, and rerun the calculations to determine your new extra payment amount.

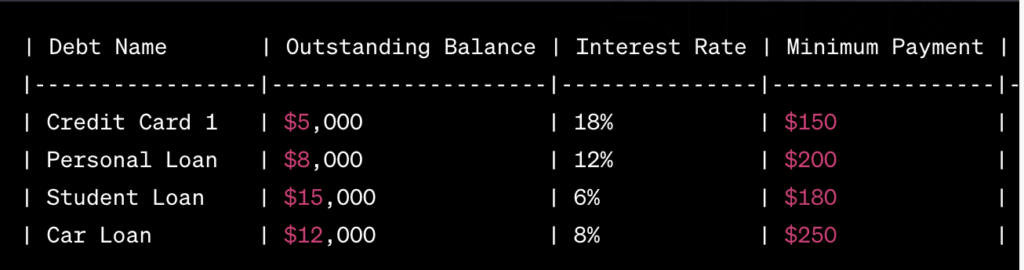

Here’s an example of a simple Debt Avalanche Spreadsheet:

In this example, we have listed four debts:

- Credit Card 1:

- Outstanding Balance: $5,000

- Interest Rate: 18%

- Minimum Payment: $150

- Total Payment (Minimum + Extra): $250

- Personal Loan:

- Outstanding Balance: $8,000

- Interest Rate: 12%

- Minimum Payment: $200

- Total Payment (Minimum + Extra): $250

- Student Loan:

- Outstanding Balance: $15,000

- Interest Rate: 6%

- Minimum Payment: $180

- Total Payment (Minimum + Extra): $250

- Car Loan:

- Outstanding Balance: $12,000

- Interest Rate: 8%

- Minimum Payment: $250

- Total Payment (Minimum + Extra): $250

To use this spreadsheet, you would:

- List all your debts, including their names, outstanding balances, interest rates, and minimum monthly payments.

- Calculate the extra payment you can afford to make each month. In this example, it’s set at $100 ($250 – $150 minimum payment for Credit Card 1).

- Sort your debts by interest rate in descending order. In this example, Credit Card 1 has the highest interest rate, so it’s at the top.

- Make minimum payments on all debts.

- Allocate the extra payment (in this case, $100) to the debt with the highest interest rate (Credit Card 1).

- As you pay off each debt, remove it from the list and recalculate the extra payment amount.

This Debt Avalanche Spreadsheet helps you track your progress, identify which debt to focus on, and ultimately accelerate your journey to becoming debt-free. You can look into some more examples at this resource to comprehend better.

Conclusion

The Debt Avalanche Spreadsheet strategy stands as a proven path to financial freedom, allowing individuals to conquer their debts strategically. By targeting high-interest rate debts first, this method minimizes interest costs, accelerates debt elimination, and paves the way for long-term financial independence.

Embarking on the Debt Avalanche journey requires determination, but the rewards – reduced financial stress, increased savings, and a debt-free future – are well worth the effort. As you follow the Debt Avalanche Spreadsheet strategy, remember that financial freedom is achievable, and the Debt Avalanche method is your trusted guide on this path.